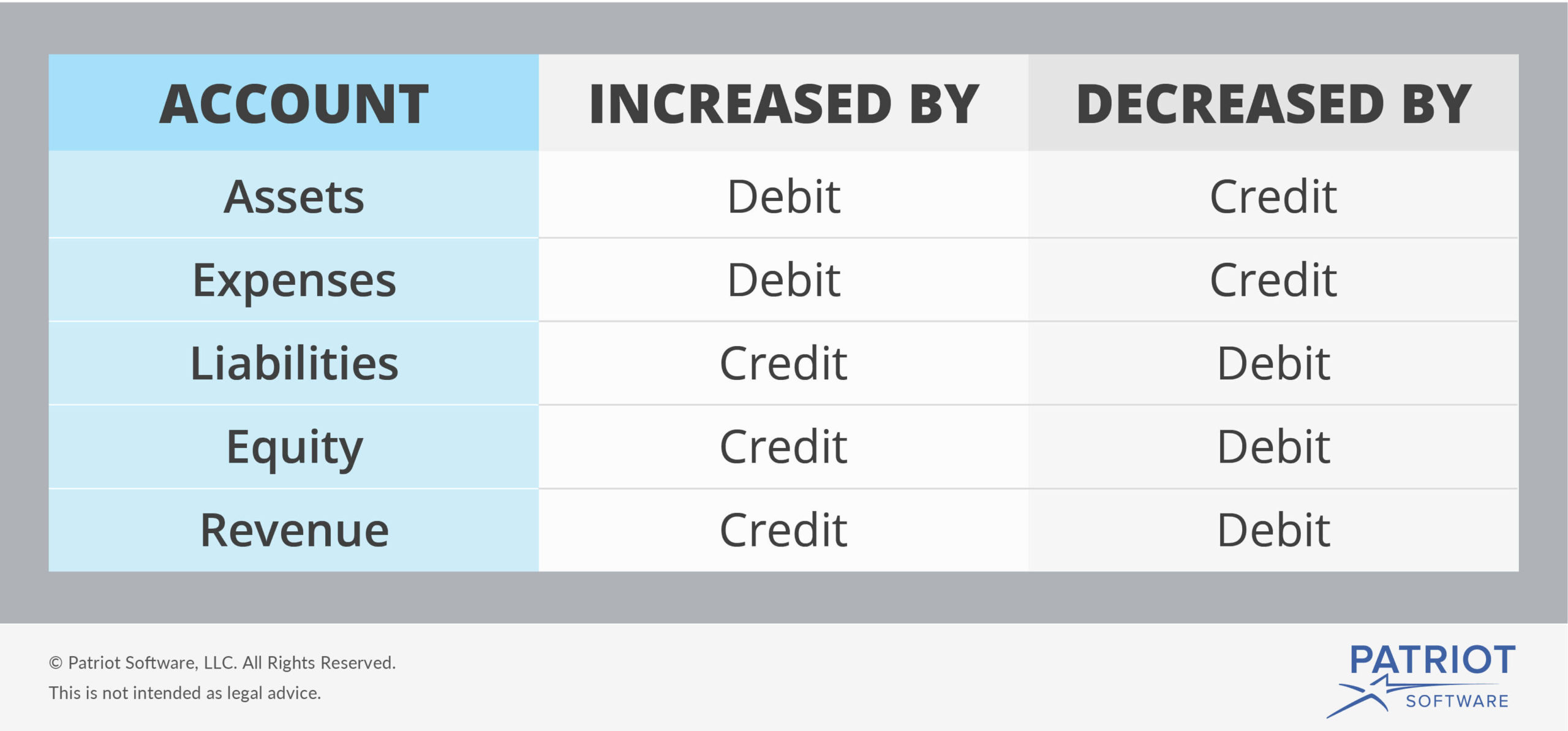

Assets on the left side of the equation (debits) must stay in balance with liabilities and equity on the right side of the equation (credits). Before getting into the differences between debit vs. credit accounting, it’s important to understand that they actually work together. Expense accounts normally have debit balances, while income accounts have credit balances. AP ledgers should be regularly reconciled with statements from suppliers at least once a month. Reconciliations should also be done whenever there is a change in the vendor’s terms, such as the expiration of an existing contract or the introduction of a new one. Finally, if any discrepancies are identified, reconciliation should be done immediately.

- When the bill is paid to the vendor, the amount is debited from the accounts payable account and credited to cash or the vendor’s bank account to reduce liability.

- Companies mostly find it convenient to record an accounts payable liability when they actually receive the goods.

- In other words, compare your records to your bank balance to ensure everything matches.

- Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others.

- These are short term obligations which arise when a sole proprietor, firm or company purchases goods or services on account.

What Are Some Examples of Payables?

When this is a short-term debt, you will later debit balance your AP account when you pay back the obligation. Accounts payable can be categorized into trade payables, non-trade payables, and taxes payable. Trade payables refer to payments on goods or services, and non-trade payables refer to business expenses that don’t directly affect operations (e.g. utility bills). Taxes payable refer to the company’s federal, state, and local obligations. Every accounts payable department has a process to follow before making a vendor payment — this is the accounts payable process.

Accounts payable process steps

Further, special emphasis must be given to accounts payable representing larger transactions. Once the sample invoices are reviewed, each of them must be confirmed and verified. You must also review and verify loans, principal balance, and interest rate. This is because few of the accounts payable can also include loans and interest payments. An ideal accounts payable process begins with a proper chart of accounts, which is statement or report that captures all your accounting transactions, including accounts payable.

Discount report

The double entries for the purchase made from XYZ Co. are as follows. Accounts payable is purchasing goods and services from vendors on credit to be paid off later. Accounts payable, being a credit or a debit, is a common question, with the answer being – it depends. This process can still be a bit tricky when it hasn’t been put into practice. Let’s look at some examples of how this will look in your accounts payable entries.

Your bookkeeper or accountant should know the types of accounts your business uses and how to calculate each of their debits and credits. In addition, it provides visibility into company spending and can help identify any potential issues or discrepancies. All changes to the business’s assets, liabilities, equity, revenues, and expenses are recorded in the general ledger as journal entries. When a company makes purchases from suppliers, it must debit its purchases account.

When Should You Accrue an Expense?

Monitoring accounts payable is a common financial function in business and plays a crucial role in cash flow management. To accurately enter your firm’s debits and credits, you need to understand business accounting journals. A journal is a record of each accounting transaction listed in chronological order. The next month, Sal makes a payment of $100 toward the loan, $80 of which goes toward the loan principal and $20 toward interest. After a month, ABC Co. repays XYZ Co. for the related purchase made above.

Accounts receivable refers to the amount that your customers owe to you for the goods and services provided to them on credit. Thus, the accounts receivable account gets debited and the sales account gets credited. This indicates an increase in both accounts receivable and sales account. Further, accounts receivable are recorded as current assets in your company’s balance sheet. On the other hand, accounts payable refers to the amount you owe to your suppliers for goods or services received from them. Thus, the purchases account gets debited, and the accounts payable account gets credited.

Accounts payable indicates purchases made on credit owed to the creditor at a later date. Accounts receivable are goods supplied to a customer on credit, owed at a later date. Errors from outside the company can also compromise the integrity of the financial data.

Upon receiving the debit note, the seller issues a credit note (also known as credit memo) to the buyer, informing him that his account has been credited. Accounts payable are usually divided into two categories – trade accounts payable and other accounts payable. The goods that are not net of tax definition and meaning merchandise are the goods that the business does not normally deals in. Accounts payable are recorded in the journal entry under credit when the purchase is made and under debit when the bill is paid. Learning how they work with accounts payable helps you understand the entire process.

Comments